|

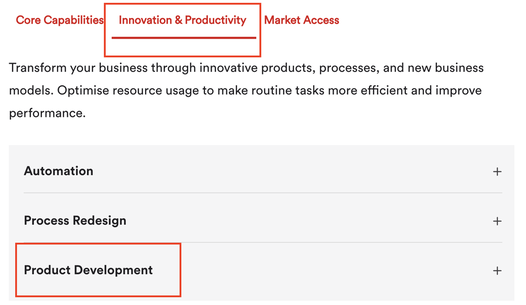

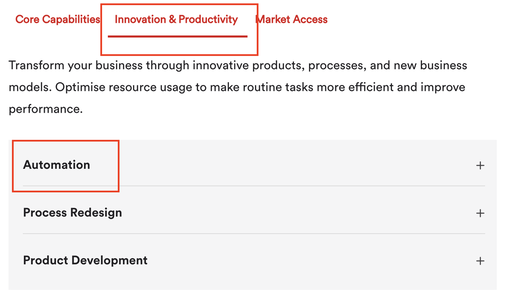

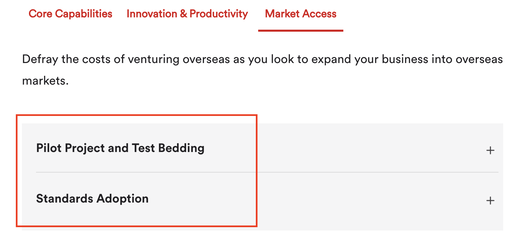

Singapore has recognized cybersecurity as a crucial priority and is fostering an environment that encourages innovation in this space.To strengthen capabilities and innovation in this strategic sector, the government has introduced various grants available to cybersecurity companies and startups. From helping firms access cutting-edge R&D to boosting adoption of new cybersecurity solutions, these funding schemes aim to position Singapore as a global cybersecurity hub. This blog post will highlight the major grants that cybersecurity solution providers of all sizes and maturity levels across Singapore should have on their radar. Whether you are looking to advance technical capabilities, expand overseas footprint, or attract talent, there is likely a relevant government grant to tap on. Read on to uncover these funding opportunities available today to help take your Singapore cybersecurity operations to the next level. 1. CAS Cybercall (ended 30 Nov 2023) The Cyber Call Grant is a new funding initiative launched by the Cybersecurity Agency of Singapore (CSA). Through this competitive grant call, up to S$1 million is available to support industry-led cybersecurity R&D projects based in Singapore. The aim is to catalyze the development of innovative cybersecurity solutions to meet national cybersecurity and strategic needs, with the potential for commercial application. More info regarding this competitive grant can be found here. Interested parties are encouraged to await the subsequent round of open applications. 2. Enterprise Development Grant 2.1 Product Development source: https://www.enterprisesg.gov.sg/financial-support/enterprise-development-grant Companies looking to develop new cybersecurity products and solutions should explore tapping on the EDG's Product Development scheme. This competitive grant provides up to 50% in project funding support for qualifying costs related to developing the first-of-its-kind products or solutions targeted at international markets. Applicants must be Singapore-registered firms with at least 30% local shareholding, demonstrate financial readiness and have existing core product offerings. The application is open throughout the year, and companies engaged in high-tech development are strongly encouraged to apply. 2.2 Automation source: https://www.enterprisesg.gov.sg/financial-support/enterprise-development-grant Singapore cybersecurity companies looking to automate processes can tap on the EDG's Automation scheme for funding. Eligible companies can receive up to 50% funding in qualifying project costs, when adopting impactful automation solutions to increase productivity. Qualifying projects should demonstrably lead to productivity gains through deploying technology such as artificial intelligence, machine learning, industrial internet-of-things sensors, and more. The application is open throughout the year. 2.3 Core Capabilities The Enterprise Development Grant also supports companies in formulating and implementing growth strategies, enhancing financial performance, and differentiating their brand and marketing strategy through projects encompassing various areas such as business development, financial stewardship, and brand proposition optimization, facilitated by external experts. These initiatives are eligible for up to 50% support with no specified cap. The application process remains open throughout the year, and companies seeking to transform their businesses are strongly encouraged to apply. 3. Market Readiness Assistance (MRA) The Market Readiness Assistance offers robust support for cybersecurity enterprises in Singapore seeking to expand internationally. Eligible companies can receive up to 50%, total cap at SGD100K per new market. Funding support for costs related to overseas market promotion, market set-up, and business development. Qualifying costs cover areas like salary for overseas business development staff, intellectual property registration abroad, incorporation of entities, as well as exhibiting at trade fairs. The grant aims to enable companies to scope out opportunities, navigate market entry barriers more effectively and accelerate commercialization efforts globally. The application is open all year round. Companies who are interested to apply must have not earned more than S$100K from the targeted market in any of the past 3 years. 4. Hiring Grants 4.1 Career Conversion Programme The CCP offers salary support up to 6 months to encourage hiring and skill transformation, providing up to 70% (below 40 years old) or 90% (40 years and above) of monthly basic salary, capped at $4,000 and $6,000 respectively. Eligible candidates, excluding shareholders and related entities, must be Singapore Citizens or Permanent Residents above 21 years old, with a minimum of 2 years' experience or 6 months unemployment. Redeployed staff with over 1 year of employment are eligible. Applications which are supported by evidence of career conversion and skills upgrading, must be submitted within 3 months of employment start date. 4.2 Mid United Career Pathway Program The Mid United Career Pathway program supports salary costs for mature mid-career individuals (aged 40 and above) transitioning careers. Eligible candidates can receive up to 70% salary support, capped at $3,800 per month for 18 months. Funding applies to basic monthly salary, excluding overtime or bonuses. Applications are open year-round based on hiring demand, aiming to encourage employers to offer career transition opportunities. Companies must commit to structured mentorship and skills upgrading for eligible mid-career hires. Further details on eligibility and funding are available here.  4.3 Global Ready Talent Program The Global Ready Talent Program facilitates global exposure for promising individuals through company-hosted internships and management associate programs. Eligible companies, with at least 30% local shareholding, can receive funding covering up to 70% of monthly allowances, with a minimum monthly internship stipend of S$800 for ITE and Polytechnic students and S$1,000 for University students. This support is available for Singaporean interns, with the program lasting up to 12 calendar months. Additionally, the grant is capped at S$50,000 annually per management associate. Companies seeking to hire interns or management associates are encouraged to leverage this grant opportunity. 5. MAS FSTI Innovation Acceleration Track The MAS FSTI Innovation Acceleration Track provides up to 50% funding support capped at S$400,000 per project for proof-of-concept trials of innovative technologies by MAS-regulated financial institutions, technology providers working with them, and solution providers developing productivity-enhancing solutions for the financial sector, with quarterly application deadlines. The funding categories cover basic manpower costs, including salaries and employee's CPF contribution, professional services costs encompassing consultancy and third-party prototyping, and equipment/hardware, data, or software costs, which include purchase expenses and project-related technical software costs. While the above grants directly benefit the cybersecurity company, there are also grants that can indirectly contribute to its success when clients leverage these opportunities to procure their solutions/ services. source: https://www.enterprisesg.gov.sg/financial-support/enterprise-development-grant

In conclusion, the world of cybersecurity is evolving at an unprecedented pace, and with the support of cybersecurity grants, organizations can fortify their defenses, foster innovation, and contribute to a safer digital landscape. As we navigate the ever-expanding realm of cyber threats, these grants not only provide financial assistance but also pave the way for groundbreaking solutions. The journey towards a more secure future is not solitary; it's a collective effort fueled by collaboration, knowledge, and the commitment to staying one step ahead. Embrace the opportunities these grants present, fortify your cyber defenses, and let's shape a resilient and secure digital future together.

For companies looking to tap on grants and incentives to grow your cybersecurity business, feel free to reach out to us: |

Other Recent BlogsTop Government Grants for Cybersecurity Companies in Singapore Top 3 Sustainability Related Grants 2023 Top 3 Grants by the Singapore Tourism Board Top 10 Grants for farming companies in Singapore Fund your startup with The Startup SG Tech CategoriesArchives

December 2023

|