|

Accessing financial resources to fuel growth and innovation is crucial in today's competitive business landscape. One of the most effective ways to secure this funding is through grants. Based on our experience at Real Inbound Consulting (RIC), here are the top five types of business projects that are supportable by grants in Singapore.

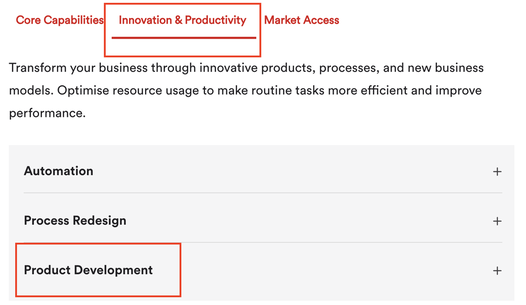

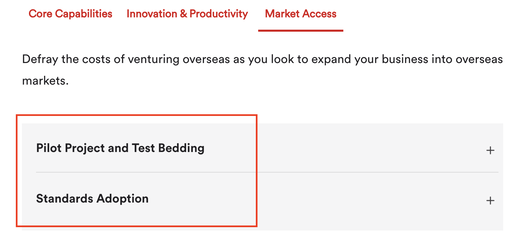

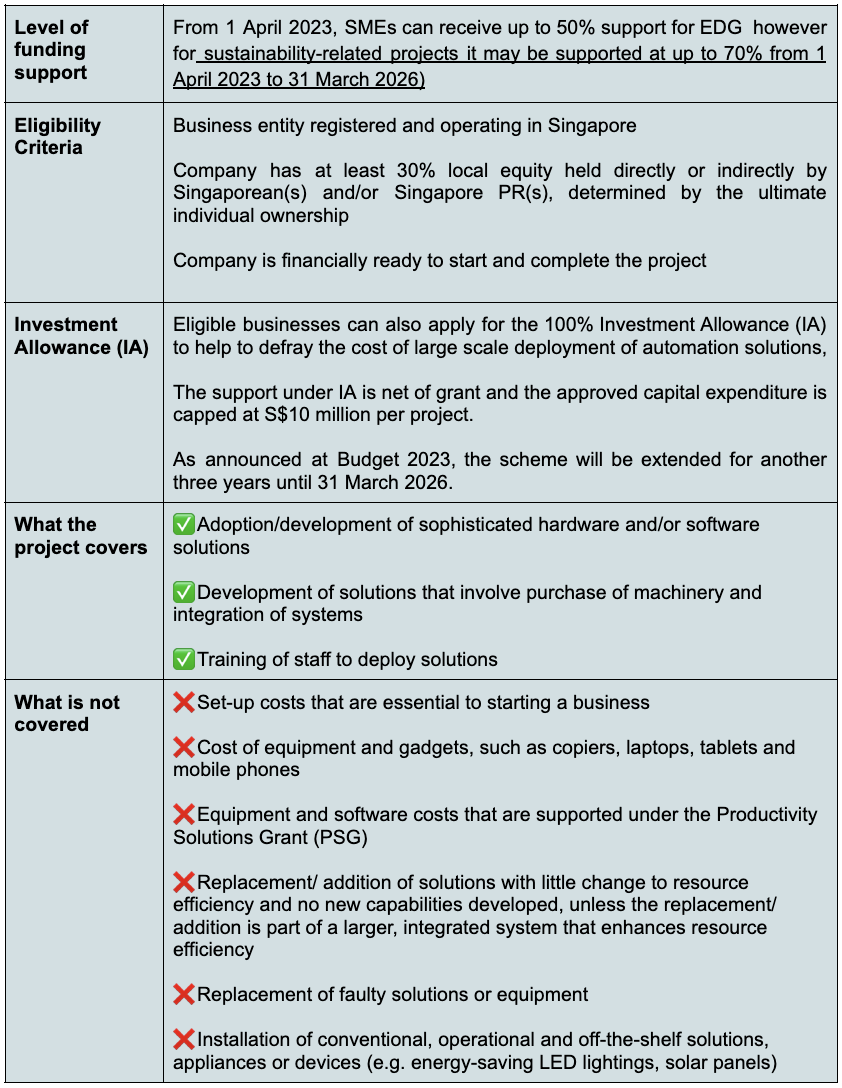

Adopting new technologies can be a game-changer for businesses looking to enhance operational efficiency. By securing financial support, your business can improve processes and productivity, automate production lines, and enhance customer engagement. This not only increases efficiency but also helps deliver more value to your clients. Implementing new technologies can often be cost-prohibitive for many businesses, especially small and medium enterprises (SMEs). However, the EDG - Automation Grant and the Productivity Solutions Grant (PSG) provide financial assistance to help offset these costs. These grants support companies in their automation and productivity efforts, including the adoption of robotics, the implementation of Internet of Things (IoT) solutions, and the integration of customized software systems. For instance, grants can cover the costs of customized software development and integration, automation equipment, and training for your staff—making it easier to integrate cutting-edge technology into your operations. At RIC, we guide you through the application process to optimize your funding outcomes. Staying ahead of the competition requires constant innovation. Grants provide the necessary funding to develop new and innovative products for commercialization. This financial support allows you to create new revenue streams, revolutionize your business model, and establish a technological edge in your industry. Product development can be a significant investment, often requiring substantial resources in terms of time, money, and expertise. The EDG - New Product Development grant helps established companies with the costs of developing new products, from initial research and prototype creation to testing and market launch. Similarly, the Startup SG Tech grant is designed for new startups with innovative tech-based solutions, supporting them through the proof-of-concept (POC) and proof-of-value (POV) stages. With grant funding, you can cover the costs associated with product development, prototype manufacturing, and testing, ensuring that your new products are ready for the market. At RIC, we assist you in navigating these grants to ensure your innovative ideas come to fruition. Expanding into new sales markets is a strategic move to diversify revenue streams and increase business resilience. Grant funding can support your business expansion efforts by covering the costs of market research, business development, and promotional activities. International expansion can open up new avenues for growth, but it also comes with its own set of challenges and expenses. The Market Readiness Assistance (MRA) Grant helps businesses defray the costs associated with expanding into overseas markets. This includes market research, participation in trade fairs, and setting up overseas offices. By reducing the financial burden of these activities, the MRA grant makes it easier for businesses to explore and establish a presence in new markets. This financial assistance helps you establish a presence in new countries, hire local business development staff, and engage in market promotion activities. By tapping into grant funding, you can lay a solid foundation for international growth and build a robust overseas team. Our expertise at RIC can streamline this process, ensuring maximum funding benefits. Securing the right talent is essential for driving business growth. Grants can help you support the salaries of new or redeployed/reskilled Singaporean employees. This financial assistance allows you to hire strategic talents necessary for your company's growth without bearing the full financial burden. Attracting and retaining top talent can be a significant expense, particularly for smaller businesses. The Career Conversion Program (CCP) and the SG United Mid-Career Pathways Programme offer substantial support for hiring and training new employees. These programs provide funding to cover a significant portion of salaries and training costs, making it more feasible for businesses to bring in the expertise they need. Grants can cover a significant portion of the salaries for a specified period, making it easier to bring in experts who can propel your business forward. At RIC, we help identify the best programs to meet your hiring needs. Engaging external consultants can be highly advantageous for executing the above projects effectively. As a professional expert in this field, we can bring specialized expertise and unbiased perspectives that may not exist within your company. Grants, such as EDG - Core Capabilities Development, can fund the engagement of certified consultants to develop business strategies, financial plans, brand development, and process redesign. External consultants can help identify areas for improvement, recommend best practices, and provide guidance on implementing new technologies. For example, a consultant could help streamline your operations by recommending specific automation tools or by devising a comprehensive R&D strategy tailored to your business needs. Engaging experts for international market expansion can provide insights into local market dynamics and help navigate regulatory requirements. Engaging external consultants can help you gain valuable insights and implement best practices that drive business growth. By leveraging grant funding, you can access high-quality consultancy services that can help you achieve breakthroughs in various aspects of your business. At RIC, we help you navigate the scope of consultancy services covered by these grants, ensuring you get the best advice and support. Grants offer invaluable financial assistance for key projects that can drive business growth, such as automation, R&D, and international expansion. This reduces the financial risk associated with these projects and allows you to undertake initiatives that might otherwise be unaffordable. By securing grant funding, you can ensure that your business has the necessary resources to execute critical projects and achieve strategic objectives. Navigating the grant application process can be complex and time-consuming. However, working with dedicated grant consultancy firms like Real Inbound Consulting (RIC) ensures that you receive optimal funding outcomes. We manage the full grant lifecycle from application to claims, ensuring timely approvals, smooth reimbursements, and peace of mind for your business. We handle everything from building effective proposals to managing project scenarios and preparing final reports, allowing you to focus on your core business activities. Grant funding provides invaluable support to businesses looking to innovate, expand, and improve operational efficiency. Leveraging these resources can significantly accelerate your business growth and ensure long-term success. By understanding and utilizing available grants, your business can unlock new opportunities and achieve its strategic goals. Sign up here to get great information like this every time we post!18th Dec 2023 The Capability Transfer Programme (CTP) is a grant introduced by the Singapore government to facilitate the transfer of global capabilities and skills into Singapore. The goal is to build deep capabilities in Singapore's local workforce and drive innovation across sectors. Eligibility for CTP Grant To be eligible for the CTP grant, companies, associations, or professional bodies need to be locally registered or incorporated, and operating in Singapore. Applications are open to entities across all sectors, including the 23 Industry Transformation Map sectors identified as growth areas. The CTP evaluates proposals on a case-by-case basis. Strong CTP project proposals should:

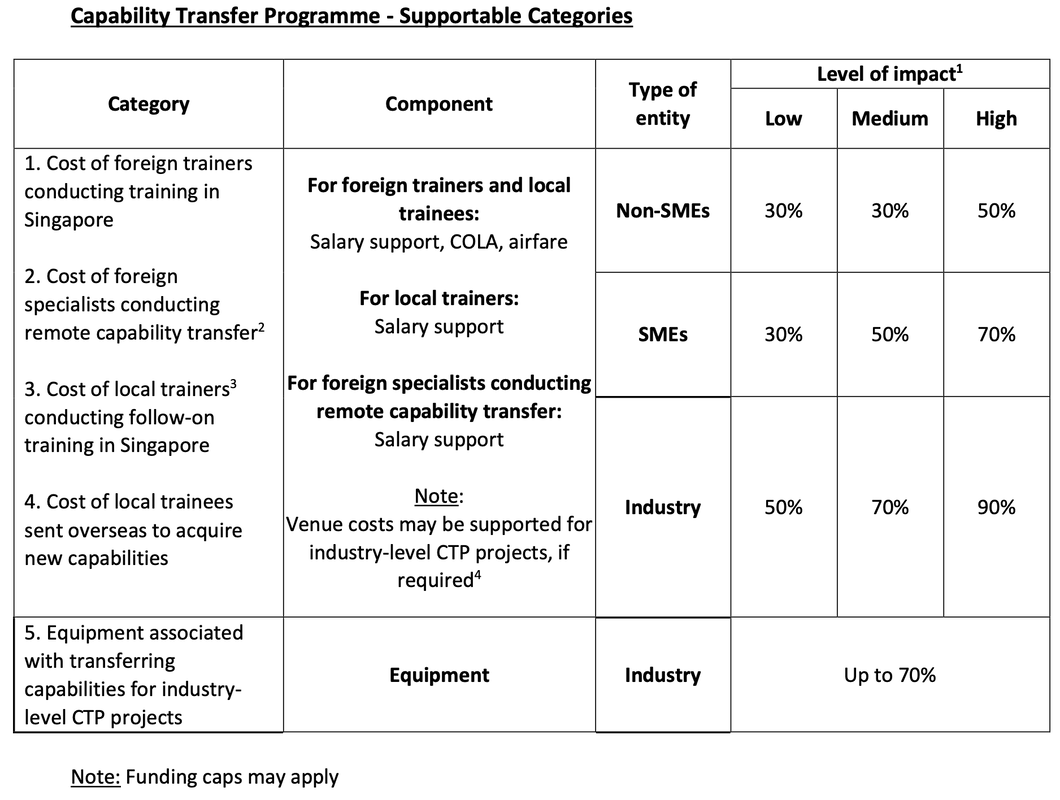

Support Levels The level of support under the CTP grant varies based on:

Supportable Costs The CTP grant can fund:

Applying for the CTP Grant

Interested companies can apply for the CTP grant by filling up an online enquiry form through go.gov.sg/wsg-ctp-enquiry-1. A Workforce Singapore (WSG) officer will then contact the applicant to discuss the proposal in greater detail. Conclusion The CTP grant presents a valuable opportunity for companies in Singapore looking to quickly obtain globally competitive capabilities. With generous government support and simple application process, the CTP facilitates skills transfer to boost innovation and workforce development. Please feel free to reach out to us if you are keen in applying for the CTP scheme. Singapore has recognized cybersecurity as a crucial priority and is fostering an environment that encourages innovation in this space.To strengthen capabilities and innovation in this strategic sector, the government has introduced various grants available to cybersecurity companies and startups. From helping firms access cutting-edge R&D to boosting adoption of new cybersecurity solutions, these funding schemes aim to position Singapore as a global cybersecurity hub. This blog post will highlight the major grants that cybersecurity solution providers of all sizes and maturity levels across Singapore should have on their radar. Whether you are looking to advance technical capabilities, expand overseas footprint, or attract talent, there is likely a relevant government grant to tap on. Read on to uncover these funding opportunities available today to help take your Singapore cybersecurity operations to the next level. 1. CAS Cybercall (ended 30 Nov 2023) The Cyber Call Grant is a new funding initiative launched by the Cybersecurity Agency of Singapore (CSA). Through this competitive grant call, up to S$1 million is available to support industry-led cybersecurity R&D projects based in Singapore. The aim is to catalyze the development of innovative cybersecurity solutions to meet national cybersecurity and strategic needs, with the potential for commercial application. More info regarding this competitive grant can be found here. Interested parties are encouraged to await the subsequent round of open applications. 2. Enterprise Development Grant 2.1 Product Development source: https://www.enterprisesg.gov.sg/financial-support/enterprise-development-grant Companies looking to develop new cybersecurity products and solutions should explore tapping on the EDG's Product Development scheme. This competitive grant provides up to 50% in project funding support for qualifying costs related to developing the first-of-its-kind products or solutions targeted at international markets. Applicants must be Singapore-registered firms with at least 30% local shareholding, demonstrate financial readiness and have existing core product offerings. The application is open throughout the year, and companies engaged in high-tech development are strongly encouraged to apply. 2.2 Automation source: https://www.enterprisesg.gov.sg/financial-support/enterprise-development-grant Singapore cybersecurity companies looking to automate processes can tap on the EDG's Automation scheme for funding. Eligible companies can receive up to 50% funding in qualifying project costs, when adopting impactful automation solutions to increase productivity. Qualifying projects should demonstrably lead to productivity gains through deploying technology such as artificial intelligence, machine learning, industrial internet-of-things sensors, and more. The application is open throughout the year. 2.3 Core Capabilities The Enterprise Development Grant also supports companies in formulating and implementing growth strategies, enhancing financial performance, and differentiating their brand and marketing strategy through projects encompassing various areas such as business development, financial stewardship, and brand proposition optimization, facilitated by external experts. These initiatives are eligible for up to 50% support with no specified cap. The application process remains open throughout the year, and companies seeking to transform their businesses are strongly encouraged to apply. 3. Market Readiness Assistance (MRA) The Market Readiness Assistance offers robust support for cybersecurity enterprises in Singapore seeking to expand internationally. Eligible companies can receive up to 50%, total cap at SGD100K per new market. Funding support for costs related to overseas market promotion, market set-up, and business development. Qualifying costs cover areas like salary for overseas business development staff, intellectual property registration abroad, incorporation of entities, as well as exhibiting at trade fairs. The grant aims to enable companies to scope out opportunities, navigate market entry barriers more effectively and accelerate commercialization efforts globally. The application is open all year round. Companies who are interested to apply must have not earned more than S$100K from the targeted market in any of the past 3 years. 4. Hiring Grants 4.1 Career Conversion Programme The CCP offers salary support up to 6 months to encourage hiring and skill transformation, providing up to 70% (below 40 years old) or 90% (40 years and above) of monthly basic salary, capped at $4,000 and $6,000 respectively. Eligible candidates, excluding shareholders and related entities, must be Singapore Citizens or Permanent Residents above 21 years old, with a minimum of 2 years' experience or 6 months unemployment. Redeployed staff with over 1 year of employment are eligible. Applications which are supported by evidence of career conversion and skills upgrading, must be submitted within 3 months of employment start date. 4.2 Mid United Career Pathway Program The Mid United Career Pathway program supports salary costs for mature mid-career individuals (aged 40 and above) transitioning careers. Eligible candidates can receive up to 70% salary support, capped at $3,800 per month for 18 months. Funding applies to basic monthly salary, excluding overtime or bonuses. Applications are open year-round based on hiring demand, aiming to encourage employers to offer career transition opportunities. Companies must commit to structured mentorship and skills upgrading for eligible mid-career hires. Further details on eligibility and funding are available here.  4.3 Global Ready Talent Program The Global Ready Talent Program facilitates global exposure for promising individuals through company-hosted internships and management associate programs. Eligible companies, with at least 30% local shareholding, can receive funding covering up to 70% of monthly allowances, with a minimum monthly internship stipend of S$800 for ITE and Polytechnic students and S$1,000 for University students. This support is available for Singaporean interns, with the program lasting up to 12 calendar months. Additionally, the grant is capped at S$50,000 annually per management associate. Companies seeking to hire interns or management associates are encouraged to leverage this grant opportunity. 5. MAS FSTI Innovation Acceleration Track The MAS FSTI Innovation Acceleration Track provides up to 50% funding support capped at S$400,000 per project for proof-of-concept trials of innovative technologies by MAS-regulated financial institutions, technology providers working with them, and solution providers developing productivity-enhancing solutions for the financial sector, with quarterly application deadlines. The funding categories cover basic manpower costs, including salaries and employee's CPF contribution, professional services costs encompassing consultancy and third-party prototyping, and equipment/hardware, data, or software costs, which include purchase expenses and project-related technical software costs. While the above grants directly benefit the cybersecurity company, there are also grants that can indirectly contribute to its success when clients leverage these opportunities to procure their solutions/ services. source: https://www.enterprisesg.gov.sg/financial-support/enterprise-development-grant

In conclusion, the world of cybersecurity is evolving at an unprecedented pace, and with the support of cybersecurity grants, organizations can fortify their defenses, foster innovation, and contribute to a safer digital landscape. As we navigate the ever-expanding realm of cyber threats, these grants not only provide financial assistance but also pave the way for groundbreaking solutions. The journey towards a more secure future is not solitary; it's a collective effort fueled by collaboration, knowledge, and the commitment to staying one step ahead. Embrace the opportunities these grants present, fortify your cyber defenses, and let's shape a resilient and secure digital future together.

For companies looking to tap on grants and incentives to grow your cybersecurity business, feel free to reach out to us: The Cyber Security Agency of Singapore (CSA) has launched a new grant called the Cybersecurity Co-Innovation and Development Fund (CCDF) to support local cybersecurity companies. This grant provides up to S$1 million in funding per project for up to 24 months.

The CCDF aims to catalyze the development of innovative cybersecurity solutions that enhance cybersecurity and address national security needs. The grant encourages collaborations between cybersecurity companies and end-users by facilitating the matching of industry proposals to end-user challenges. Cybersecurity companies that are registered in Singapore are eligible to apply. Overseas companies can also qualify if they partner with a Singapore-registered company. At least 50% of the project team must comprise Singapore residents or permanent residents. The grant covers costs related to manpower, equipment, professional services, and software required for developing the cybersecurity solution. Funding is provided on a reimbursement basis upon achievement of project milestones and submission of relevant supporting documents. Proposals are evaluated based on several criteria including the uniqueness and innovation of the proposed solution, its applicability and benefit to the wider cybersecurity industry, and the competency of the project team. The CCDF is now open for applications under the Cybersecurity Industry Call for Innovation (CyberCall 2023). Interested companies can visit the CSA website for more details and submission instructions. This is an excellent opportunity for cybersecurity companies looking to develop cutting-edge solutions that tackle current and emerging threats. The grant provides substantial support for the high costs of research and development. It allows companies to focus their resources on innovation rather than worrying about funding constraints. For companies looking to tap on grants and incentives to grow your cybersecurity business, consult an experienced grant consultant in Singapore. They can advise you on available grants, help you with the application process, and ensure you put your best foot forward to win the grant. Reach out to us today for a consultation! RIC is partnering with a leading webflow technology developer, RMD HK, to help Hong Kong companies implement the latest technology stacks to maximise productivity with significant support from government grants. The partnership between RIC and RMD is a unique one. RIC has a deep understanding of the grant landscape with over eight years of track record in helping businesses secure grant financing, while RMD has a proven track record in delivering solutions in these areas:

This combination of expertise will allow both companies to offer their clients a truly unique and valuable service of enabling the adoption of the latest technologies to improve productivity with support from government grants. Gerald Yap, the founder of RIC, remarks: "We would love the opportunity to discuss how our joint offering can benefit your company. Whether you're looking to upgrade your website, implement an ERP system, develop customised software modules or secure grant funding for other types of projects, we are here to support you every step of the way."

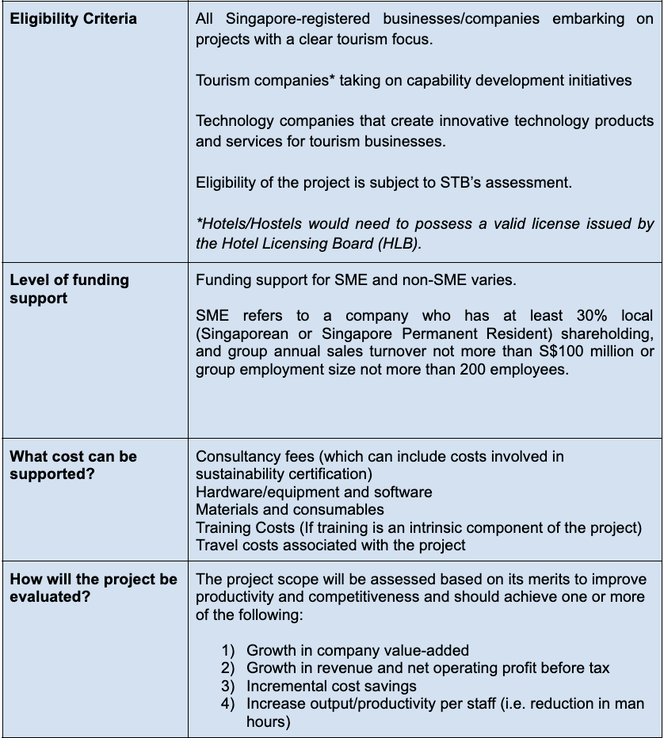

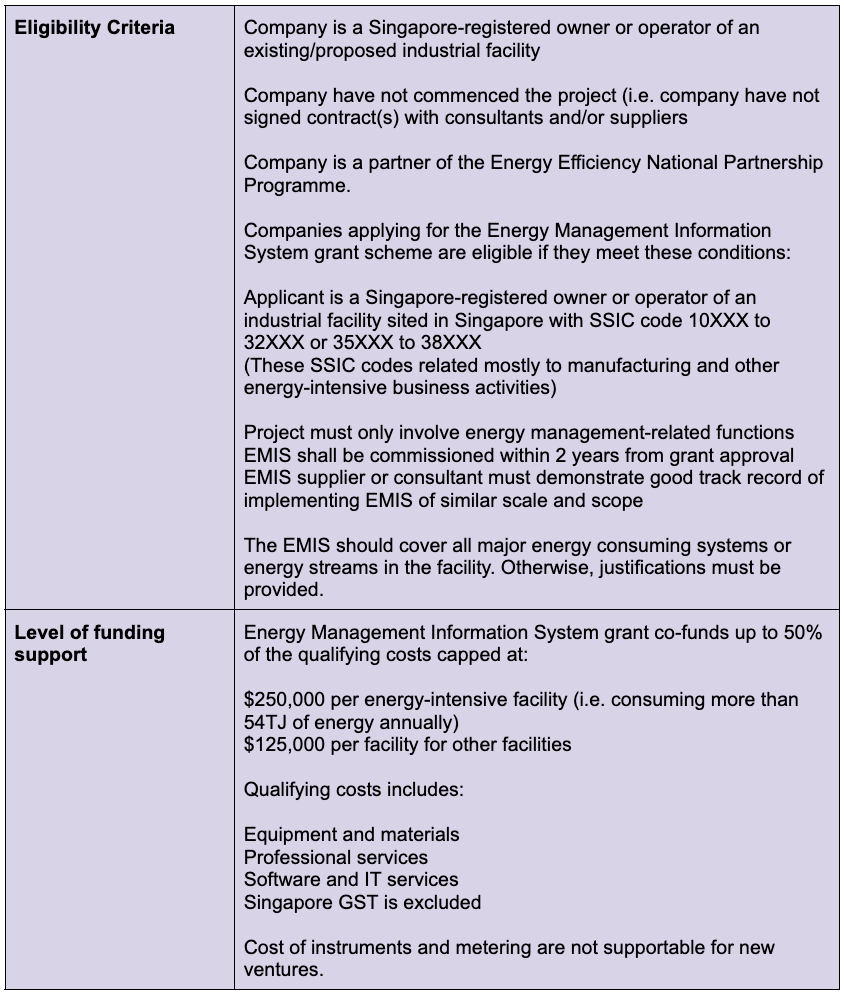

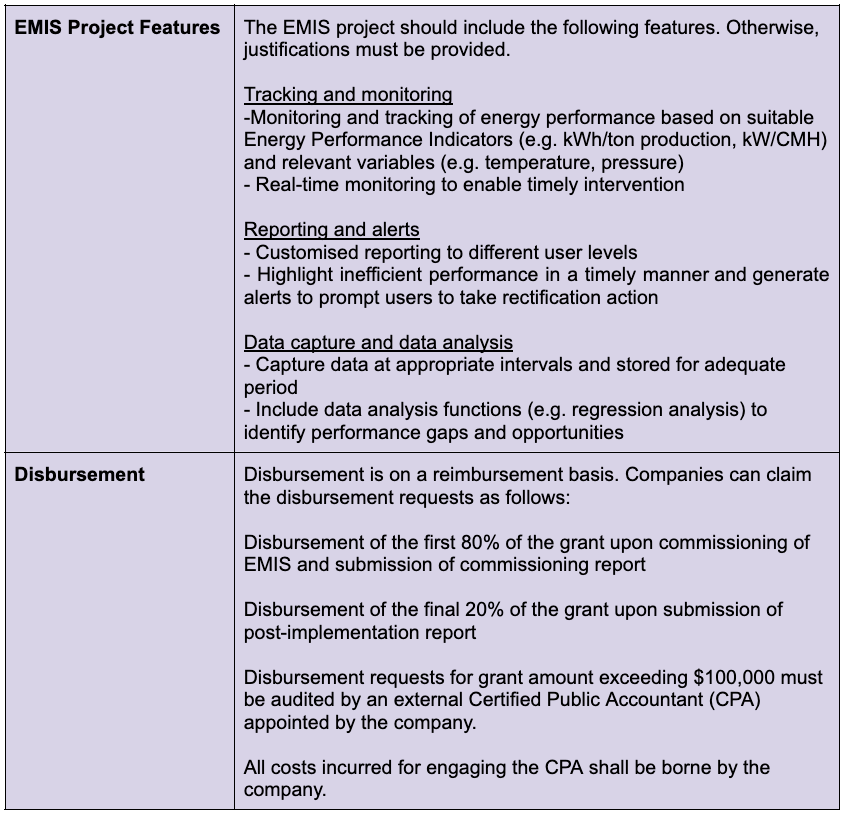

If you are interested in learning more about the partnership between RIC and RMD, please visit our joint landing page. The Singapore Green Plan 2030 is a comprehensive plan launched by the Singapore government to enhance the country's sustainability and resilience over the next decade. Government has introduced sustainability grants to enterprises across all industries. Below are the top 3 grants for enterprises to integrate sustainability into their business to capture new opportunities in the green economy. Enterprise Sustainability Programme (ESP) Enterprise Singapore offers the Enterprise Sustainability Programme to support Singapore companies, especially the SMEs, to build capabilities and capture new opportunities. The ESP is designed to help companies get better at navigating their sustainability journey and supports various capability and product development projects via the Enterprise Development Grant. 1) ESP-Innovation & Productivity- Automation: This grant helps companies to transform their business through innovative products, processes, and new business models. It optimized resource usage to make routine tasks more efficient and improve performance through automation and technology. **Employers eligible for the SkillsFuture Enterprise Credit can qualify for additional subsidies under the scheme. Business Improvement Fund (BIF) Singapore Tourism Board (STB) offers the Business Improvement Fund (BIF). It is a grant administered by the STB which aims to encourage technology innovation and adoption, redesign of business models and processes in the tourism sector to improve productivity and competitiveness. 2) BIF- Innovation & Productivity: Automation Projects under Innovation & Productivity support companies that explore new areas of growth or look for ways to enhance efficiency. These could include reviewing and redesigning workflow and processes. Companies could also tap into automation and technologies to make routine tasks more efficient. Energy Efficiency Fund (E2F) The Energy Efficiency Fund (E2F) is an umbrella scheme consisting of 5 different grants to support businesses with industrial facilities to improve energy efficiency (EE). One of them is the Energy Management Information System. 3) Energy Management Information System (EMIS) Energy Management Information System grant support companies to install EMIS to monitor and manage energy consumption in a structured manner. **Companies who are not partners can register here.

The Singapore Government offers a variety of grants to support sustainability projects for business. If your business is eligible for any of the grants above, please contact us to get a free consultation. Thereafter, should you decide to engage us, we can assist you in your end-to-end grant application and claims journey. This is a fireside chat with the founder of Real Inbound Consulting, Gerald Yap. It showcases his views on the SME consulting landscape, how he runs his team, as well as his future plans for the company.

Profile of RIC: Real Inbound Consulting (RIC) is a management consultancy firm headquartered in Singapore which helps businesses commercialize new technology, expand overseas, digitalize operations, and automate production lines. RIC also supports its clients in securing financing that supports the above-mentioned initiatives and projects, where such financing can be secured from government grants, commercial loans, or equity investments. RIC serves companies across a wide range of industries and growth-stages (SMEs, MNCs, start-ups), and handles projects of value ranging from USD thousands to millions. 1. How do you see the SME consulting market developing in Asia? What are the major factors that have been driving the market’s growth? To answer this question, we firstly define the market that RIC plays in. For RIC, we serve SMEs in two areas - helping SMEs plan and make recommendations for projects relating to company transformation and expansion (see the four areas mentioned in the profile section), as well as support them in securing external financing to fund the execution of such projects - be it grant financing, commercial loans or equity investments. We see the market for such a combination of services growing very well in the recent years for us. Factors that have been driving market’s growth:

2. What are the major problems and expectations that customers have from the players of this segment? How do you strategize to meet those? One of the problems we see in this segment is that SME owners perceive management consultants negatively due to previous encounters with some which displayed unprofessional conduct. They have also become hyper-aware of consultants due to previous experiences with scams and the consultants ‘ghosting’ them after collection of pre-paid fees. Correspondingly, we see that most SMEs today expect that the consultants they work with be a professional company with an experienced team and good track record, instead of just a one-man-show business. SMEs may also expect that the consulting company hold some certification that is recognised by an industry-body in the field of their specialty. Importantly, SMEs need to be convinced that the consulting firm they work with is sincere in helping the company and serve as a valuable partner in growing the business for the long haul- and not just ‘here to make a quick buck’. At RIC, while we are no way near perfect, we try our best each day to provide our services in the most professional manner possible; and to create to most value for our clients as we reasonably can. To ensure we meet the above objectives, we ensure that this mindset is constantly manifested by our team in whatever we do. We make it part of our DNA. In every engagement and action with a client, we ask ourselves: “Is doing this in the best interest of the client? Would doing this allow us to become a valuable partner of our client that can guide them through various stages of growth and capital requirement, and not just fulfilling a one-off ad hoc project alone?” This mindset has benefitted us in enabling continual, long-term business relationships with our clients. For example, one of our clients is a developer of offshore renewable energy projects which has been partnering us for more than three years. RIC started off by helping them with the R&D of a new offshore solar floating platform technology and raising grant financing to build a prototype. We were then brought in to do the same for other R&D projects in the pipeline. Thereafter, we helped them commercialise their productised technology in overseas markets like US and Korea. Currently, we are still engaged with this client, exploring potential in helping them raise project financing for the offshore renewable projects they are looking to develop. This type of engagement is what keeps the RIC team passionate about what we do. 3. How is Real Inbound Consulting positioned in the SME consulting market? We believe we have a unique positioning- as we are not only able to help companies with planning their projects and making recommendations on how best to approach them, but also raising external financing for the companies to execute on them. For example, if a company is looking to digitise their inventory management operations, we first do a detailed study of their current processes and identify inefficiencies and wastages. We then consult with stakeholders and develop a future desired process flow, along with detailed process map diagrams. We then do a technology scan to identify suitable tools or software systems that can fulfil the identified needs and to-be processes; and help them find and evaluate technology vendors. If the client goes ahead with our recommendations, we can help them secure financing (grants or loans) to purchase and implement the solution. In addition, we see that the business areas that our services address (overseas expansion, new product development, automation, digitisation) are all aligned with the critical areas any company needs to look at to achieve meaningful growth and scale. We have deliberately positioned our services to embody the essence of what companies need to thrive. As our services can apply to companies in any industry, we also need to ensure our team possesses a good breadth of knowledge across many industry domains. Some examples of the interesting industry domains that we have developed expertise (in addition to the traditional industry verticals) include telecommunications technology, agritech, biotech, cleantech, fintech, renewable energy technologies and alternative proteins. Since our service relates to raising external financing for SMEs to execute on their projects, we also ensure that our team is well verse with the SME funding schemes available, especially in relation to grant financing. This is an area we put considerable effort in keeping ourselves abreast on, as such schemes are constantly updated and replaced with newer schemes by the funding agencies. 4. Walk us through the approach of the firm in delivering quality services to the clients. What are the key benefactors helping you attain the same? I would list the following approaches we take to delivering quality service:

The key benefactors that help us in continually delivering quality services: Our clients themselves:

Our staff:

Our partners:

5. What are the key specifications of the range of services delivered by the firm? Highlight the USP. The set of services we offer is split into two parts:

For (i), these are examples of what we can consult on for clients: Develop and Commercialize New Technology

Expand Overseas

Digitalise Operations

Automate Production Lines

USPs: We are not only able to help companies with planning their projects and making recommendations on how best to approach them, but also raising external financing for the companies to execute on them. 6. Tell us about the team of Real Inbound Consulting. How are your combined skills and experience helping the firm to grow? We currently have a team of 7 of us (as of Jan 2023). This is split into different roles: BD, Client Operations (which includes Technical Writers and Project Managers) and Finance & HR. In helping the firm grow, proper teamwork and a tight understanding between divisions is critical. While each of us in RIC specialises in different divisions involved in the consulting value chain, we working closely with each other to ensure clients get a unified consultancy delivery that does not seem disconnected at any parts. A common issue faced by professional services firms is that the sales team overpromises and puts undue pressure on operations and the execution team to deliver. Clients then find misalignment between what sales has committed versus what the operations team eventually delivers. We are especially cognisant of this, and constantly try our best to ensure that our sales team is closely aligned with our operations team on what we can or cannot do for any particular client, and making sure Sales is meticulous in handing over every deal well to Ops for execution. We constantly try to grease the interface between divisions so as to ensure everyone internally is on the same page on what and how to deliver to the client. In addition, we tap on a network of competent advisors, leveraging their experience and connections to help us grow. Such advisors have been critical in helping us connect our clients to funding sources like investors, banks, government agencies. More importantly, they have also contributed technical knowledge to help RIC deliver successful consulting projects to clients in niche industries and with uncommon requirements. A good example would be time where RIC was helping a NASDAQ-listed company enter the Singapore market with a product that had a comprehensive set of technical features. With the help of advisors with the relevant domain knowledge with similar types of products as well as the right connections into the relevant government authority, RIC was able to help the client have their product pre-approved by the government for fast-track grant support for the benefit of customers looking to buy their product. This aided the client significantly in accelerating their product roll-out in Singapore. 7. Please elaborate, what are the key points that differentiate your company from other players in this segment?

(ii) An Agritech company which RIC served is today helping farmers in third-world countries significantly improve their crop yields, fetch the better prices for their crops by connecting them to global buyers, and improving the efficiency of the agricultural supply chain between nations. For us, being in RIC is about making a commitment to consistently improve and grow ourselves so that we can better serve good companies to make a positive impact in the world. 8. How has been the journey of the company since its inception? Walk us through the growth it has received in terms of clients and geographical expansions. The story of RIC started all the way back when I was still in university. Back then, I saw a clear need for a consultancy service like this after interning with a few companies. I started out as a one-man show, serving our first few clients which are mostly traditional businesses. Apparently, what I learnt in university and across multiple internships was already able to provide value to these businesses. After graduation, while I went on to work under several companies in the technology space, I kept RIC running as a side hustle as a freelancer (while ensuring that I do not flout any terms under my full-time employment contract). Faced with the challenge of juggling RIC commitments with a full-time corporate job, I started building up a small team and delegated responsibilities. RIC was no longer a one-man show. RIC started to serve more clients, and it got to a point where the take-home profits from RIC exceeded the income of my full-time job. It was then I made the switch to do RIC as a proper business, full time. Our client base and team size expanded significantly, and we started to secure projects of higher value and larger scope. We also started to onboard more stakeholders and partners. Many years have passed since, and I’ve never looked back. Life today is constantly charged with drive and sense of mission to help good companies do better. I am privileged in knowing that every second spent on RIC is contributing towards building something of long-lasting value and helping deserving companies actualise projects that can bring a positive impact to economies and societies. Today, RIC mainly operates in the Singapore market. However, one key agenda I am pursing right now is to make our consulting operations scalable in order to facilitate overseas expansion. We are now looking at the Hong Kong and Australian markets with interest. 9. Where do you see this market in the near future? What is the future roadmap for your Company? The market should continue to be strong- as almost all companies will see the need to expand overseas, develop new innovative products, digitise, and automate their production for increased efficiency. In addition, such companies will likely also consider help to raise external financing (on favourable terms) to fund the above project as much as they can so as not to disrupt day-to-day operational cashflow or having to draw-down from their ‘war chest’. One direction our future roadmap can head towards is in the development of new, scalable B2B services in addition to what we already provide to SMEs. If we can do this successfully, it can strengthen our position as a one-stop consultancy partner of choice for many of our clients. For our clients, it is easier for them to just go with a preferred trusted service provider to meet as many needs as possible, instead of having to spend time evaluating and trying out new service providers for new needs all the time. 10. Is there anything you think that the audience must know about your company? People are often curious about how the name of the company was conceived. One first glance, ‘Real Inbound’ it seems pretty unrelated to a management consulting business. However, this term was intentionally selected to highlight the firms’ commitment to the ‘Inbound Methodology’. According to Hubspot, the inbound methodology in business is ‘the method of growing your organization by building meaningful, lasting relationships with consumers, prospects, and customers. It's about valuing and empowering these people to reach their goals at any stage in their journey with you.’ That perfecting sums up what we embody as an organisation, and hence the name ‘Real Inbound’. The Singapore Tourism Board (STB) is a statutory board under the Ministry of Trade and Industry of Singapore. It champions the development of Singapore's tourism sector, one of the country's key service sectors and economic pillars, and undertakes the marketing and promotion of Singapore as a tourism destination. The Singapore Tourist Promotion Board (STPB) was first established in 1964 with the mandate to promote Singapore as a tourist destination. It signaled the government’s recognition of tourism’s potential as an important contributor to the country’s economy. The tourism sector currently contributes 4 percent to Singapore’s gross domestic product. Tourism plays an essential role in reinforcing Singapore’s status as a vibrant global city that is a magnet for capital, businesses and talent. It also enhances the quality and diversity of leisure options for local residents and helps to create a living environment that Singaporeans can be proud to call home. To reflect a major shift in the way tourism was championed as a key economic driver, STPB was renamed the STB in 1997. STB expanded its role beyond destination promotion and started to establish Singapore as a regional tourism hub for both tourism companies and tourists. It marked a decisive move towards tourism industry development, an approach that continues to distinguish STB from many other national tourism organisations that focus almost exclusively on marketing and promotional activities. STB strives to ensure that tourism remains an important economic pillar through long-term strategic planning, and by forging partnerships, driving innovation and ensuring excellence in the tourism sector. It continues to market Singapore’s multi-faceted appeal as a premier business and leisure destination, and offer empowering and customised experiences. STB strives to bring the Passion Made Possible brand to life by differentiating Singapore as a vibrant destination that inspires people to share and deepen their passions. This is a unified brand between STB and Economic Development Board (EDB) which will allow the international marketing of Singapore for tourism and business purposes. STB also regularly reviews and updates the tourism regulatory framework to ensure its relevance in the current business environment, while providing support and incentives to catalyse the private sector to take the lead in investing for growth. Top Grants by STB To support the industry in the drive towards quality tourism growth, Singapore Tourism Board (STB) offers assistance in the form of various grant schemes for tourism-related industries and events. STB, as the lead agency for tourism, can facilitate the application of other grants by other Singapore government agencies such as the Economic Development Board, and Enterprise Singapore, if the projects support quality tourism outcomes. STB recently unveils a new four-year Tourism Development Fund (TDF), designed to catalyse the creation of innovative and quality tourism products and experiences, and capability and employee upgrading efforts among tourism-related enterprises.

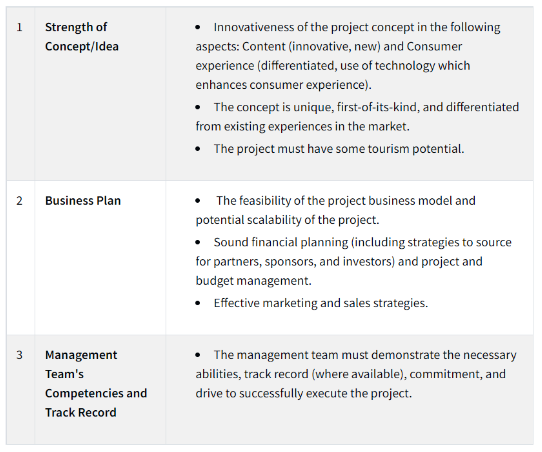

With the enhancements made to TDF, STB is committed to partnering the tourism sector in driving tourism recovery and transformation efforts. In the sections that follow, we introduce the top few grants from STB which are the most relevant and accessible for tourism-related businesses: Details of Funding Schemes: 1. Tourism Product Development Scheme > Experience Step-up Fund (ESF) The Experience Step-Up Fund (ESF) supports the development and enhancement of Singapore’s tourism experiences that increase the attractiveness of Singapore to visitors. Eligibility Criteria: The ESF grant is open to all legal entities and Singapore government agencies. Proposed projects should fall under one of the following categories: ● Development of new products and experiences (including virtual experiences) ● Content enhancements ● Technology enablers ● Amenities enhancements ● Infrastructure enhancements Grant Support: Successful applicants will receive funding support for qualifying costs, subject to the scope of the project and STB's evaluation of the merits of the project. Qualifying costs may include third-party project-related costs such as professional services, hardware/equipment and software, materials and consumables, production (1), and/or marketing (2) costs; and internal manpower costs (only applicable for tour development and tech enabler projects). (1) For production costs of new products and/or new packaging for souvenirs, funding support is only applicable to the first run of production (2) For marketing costs of qualifying media (print, digital and video) for overseas promotion/distribution, funding support is only applicable for a maximum period of 6 months Application Process: Step 1: Pre-Application Interested applicants are advised to provide an executive summary/ brief description of the proposed project to [email protected]. An STB officer will be in touch to assist further. The STB officer in-charge of the project will advise the applicant if the proposed project is eligible for ESF and to proceed with the application. Step 2: Application The applicant prepares the project proposal and estimated breakdown of project costs for submission with the application. To apply for the grant, the applicant needs to log in to the Business Grants Portal (BGP) using a CorpPass. Application Evaluation: Proposed projects will be assessed on how they develop tourism experiences to improve visitor satisfaction (especially tourists), increase footfall, increase revenue and/or enhancing the overall destination branding. 2. Tourism Event Development Scheme > Kickstart Fund (KF) The Kickstart Fund supports the creation and test-bedding of innovative consumer-focused concepts and events with strong tourism potential and scalability. This is with the aim of adding to the existing quality tourism software and enhancing the vibrancy of Singapore as a tourist destination. Eligibility Criteria: The Kickstart Fund is open to all legal entities, for e.g. businesses, companies, associations, institutes, etc. Qualifying projects include customer-focused events and concepts (including pop-ups), such as multi-disciplinary/ hybrid/ virtual events which can cut across multiple lifestyle and/or business sectors, including B2B2C events. Grant Support: Successful applicants will receive funding support for qualifying costs, capped at a maximum grant of up to $250,000 per edition (multi-edition supported, up to 3 editions over maximum 3 years). Examples of qualifying costs include costs for professional services, equipment & materials, production and marketing costs, as well as internal manpower costs. Funding support is awarded based on STB's evaluation of the scope and merits of the project. Application Process: The applicant should submit a scanned copy of the completed and signed grant application form, along with relevant supporting documents such as a project concept proposal, a detailed business plan, project budget and CV of key team members as well as track record (if any), to [email protected]. (Please note that digital signatures are not allowed.) Only complete applications will qualify for evaluation. A project should not commence prior to STB's offer of the grant. Similarly, project qualifying costs should only be incurred after STB's grant offer. Applicants are encouraged to contact STB at least three months before project commencement. Application Evaluation: Funding support is awarded based on the scope and merits of the application. STB will evaluate the application/proposal based on the following evaluation considerations: 3. Tourism Capability Development Scheme > Local Enterprise and Association Development Programme (LEAD) The Local Enterprise and Association Development Programme (LEAD) is overseen by Enterprise Singapore and Singapore Tourism Board (STB) to support efforts by Trade Associations and Chambers (TACs) to drive industry initiatives, focusing on areas like technology and infrastructure, business collaborations, as well as intelligence and research. STB supports tourism-related associations by strengthening their capabilities to enable them to take on a greater leadership role to drive the development and growth of their respective industries and precincts. Eligibility Criteria: LEAD is open to trade associations and chambers (TACs) which can include Singapore-registered societies, professional bodies, unions of employers, overseas business chambers and companies limited by guarantee. These include Singapore-registered tourism-related associations from industries (such as Attractions, Hotels, Travel Agents, Tourist Guides, MICE, Cruise) and from precincts (such as Orchard Road, Chinatown and Little India). Proposed projects should involve areas such as training, technology & infrastructure development, business capabilities development, as well as market & channel development and brand development. Grant Support: Successful applicants will receive funding support for qualifying costs, subject to the scope of the project and STB's evaluation of the merits of the project. Examples of qualifying costs include third-party costs related to professional services, equipment and materials, business development, training and manpower-related costs. Application Process: Interested tourism-related associations should email to [email protected] with a brief description of the association's aims and the proposed project(s). An STB officer will be in touch to assist the applicant further. The STB officer in-charge of the project will advise the applicant if the proposed project is eligible for LEAD and to proceed with the application. (Please note that projects that have commenced prior to STB’s offer of the grant may not be eligible.) Application Evaluation: Each application will be assessed on a case-by-case basis. Generally, STB would take into account various factors including, but not limited to, the association's financial position and operating track record, developmental plans for the industry or precinct, and the nature of the projects. Conclusion: In its pursuit of Quality Tourism, STB understands it can neither work in isolation nor spearhead all aspects of development in Singapore's tourism sector alone. Collaborating with and supporting other public agencies and the private sector is vital for the sector's success. STB supports, incentivises and catalyses the private sector to take the lead in investing for sector growth and industry competitiveness. If you need help applying for any grants from the STB, feel free to check out how RIC can help here. To strengthen Singapore’s food supply chain and increase food security by developing urban farming, the Singapore Government has various grants and funds to encourage farming companies to use technology and encourage local development of agriculture. This is to work towards the ‘30 by 30’ goal — to build up our agri-food industry’s capability and capacity to produce 30% of our nutritional needs locally and sustainably by 2030. This target also features in the Singapore Green Plan 2030 and will help build a more resilient food future. Here, we briefly list out some attractive grants/funds which aligned with the theme: 1. Agri-Food Cluster Transformation (ACT) Fund - Technology Upscaling (TU) This grant from Singapore Food Agency (SFA) supports the purchase of large commercial-scale, automated, and advanced farming technology solutions that will be integrated with agri-input production, post-harvest, and waste treatment technologies. SFA licensed Singapore-based farms that are setting up new farm sites or retrofitting indoor spaces within ready industrial spaces for farming can also tap on the fund. Applicants must have a secured farm site for implementation of the proposed farming system. Applicant’s farm should be free of unauthorized or illegal activities for the past 1 year and completed any on-going approved projects co-funded by SFA to be eligible for ACT TU grant. The maximum funding support for Technology Upscaling project is capped at $4.5mil for farming technology/system; and $1.5mil for farm-related infrastructure cost. The total funding amount that can be awarded to an applicant during the 5-year availability of ACT Fund is $6mil. The level of funding will also be subject to the merit of the project scored by an internal SFA’s panel against the set of evaluation criteria such as farming capacity, impact on productivity, economic viability and technical capability etc. The application period is from 30 April to 31 Dec 2025. Project implementation period is 18 months from the date of Letter of Offer (LOF). 2. Agri-Food Cluster Transformation (ACT) Fund - Productivity Solutions Grant (PSG) for Capability Upgrading (CU) Component This grant co-funds the purchase of farm equipment and systems from SFA's pre-qualified list and expenses related to the Clean & Green (C&G) Standard adoption and GAP certification. Eligibility for this grant is similar to ACT TU grant above, while evaluation criteria is based on the impact on farming capacity and productivity, and improvement in sustainability. The total funding amount that can be awarded for the 5-year is $100,000 (inclusive of one-off $15,000 for qualifying C&G consultancy fees ($10,000) and certification-related fees ($5,000)). The Capability Upgrading component will be available as part of the Productivity Solutions Grant (PSG) from 30 Apr 2021 to 31 Dec 2025. Project implementation period is 6 months from the date of Letter of Offer. 3. NEA 3R This is a co-funding scheme to encourage organizations to reduce waste disposed of at National Environment Agency (NEA)'s incineration plants and disposal facilities through the implementation of waste minimization and recycling projects. This grant is available to any organization in Singapore, at any time of the year, based on a first-come, first-served basis, subject to the availability of funds. Eligible projects must result in an increase in the quantity of solid waste (excludes toxic and chemical wastes) recycled or a reduction in the quantity of solid waste generated. The minimum tonnage eligibility is 100 tones reduced, reused or recycled over the whole project duration. Projects also must not have commenced at the time of application. The 3R Fund will co-fund up to 80 per cent of qualifying costs, subject to a cap of $1 million per project or per applicant. For multiple onsite waste treatment systems within the same premises or in different premises, the qualifying costs of the system will be tiered accordingly as below:

The maximum project duration is 3.5 years. In addition, the minimum duration of the operational phase is one year. 4. SG Eco Fund This is a $50 million grant from the Ministry of Sustainability and the Environment Singapore which was set up in 2020 to support projects that advance environmental sustainability and involve the community. Any Singaporean individual, group or organization can apply for this grant if your projects improve the environment or advance environmental sustainability in Singapore; engage and/or involve the community; and not have obtained funding from other government sources. The SG Eco Fund has two categories: Sprout (Up to $10,000 can be submitted throughout the year) and Main (more than $10,000 can be submitted between 1 May and 31 August each year). The SG Eco Fund can support up to 80% of supportable cost items, capped at $1 million. Grants will be given out on a reimbursement basis, upon completion of project milestones, and should be submitted within three months of the project completion date. 5. Energy Efficiency Fund - Energy Efficient Technology

This is another fund from the National Environment Agency which supports companies to adopt energy efficient equipment or technologies. The grant quantum will be calculated based on the total amount of carbon abatement achieved by the project, subject to a cap of 70% of the qualifying costs. Eligible applicants must be a Singapore-registered owner or operator of a manufacturing facility sited in Singapore with SSIC code 10XXX to 32XXX, and has annual group sales turnover of less than $500 million. Eligible projects must involve installation and use of energy efficient equipment or technologies with proven track record of energy savings in an industrial facility. The project must result in measurable and verifiable energy savings; and shall be completed within 36 months from the approval of grant. Disbursement is on a reimbursement basis. Companies can claim the full grant amount after project completion and energy savings are measured and verified. 6. Energy Efficiency Fund - Energy Management Information System (EMIS) Another NEA grant supports companies to install EMIS to monitor and manage energy consumption in a structured manner to achieve efficiency improvements. Energy Management Information System grant co-funds up to 50% of the qualifying costs capped at:

The applicant must be a Singapore-registered owner or operator of an industrial facility sited in Singapore with SSIC code 10XXX to 32XXX or 35XXX to 38XXX. Project EMIS must only involve energy management-related functions and should be commissioned within 2 years from grant approval. The EMIS should cover all major energy consuming systems or energy streams in the facility. Disbursement is on a reimbursement basis. Companies can claim the disbursement requests as follows:

7. Research and Innovation Scheme for Companies (RIS(C)) This scheme encourages companies in Singapore to conduct or expand their Research & Development (R&D) activities in science and technology. The co-funding support is up to 30% qualifying project costs such as manpower, training, consultancy, equipment, software, intellectual property, and materials costs. Local manpower may be accorded support of up to 50%. The timing for project execution is 3 years 8. Enterprise Development Grant (EDG) - Innovation & Productivity: Automation Enterprise Singapore offers this grant to support eligible company’s usage of automation and technology which can result in tangible benefits, significant growth and resource efficiency, such as automation of production lines using robotics, artificial Intelligence, or implementing customized ERP and production management software, etc. Eligible businesses can also apply for the 100% Investment Allowance (IA) on the qualifying equipment costs net of grant, capped at S$10 million per project. The 100% IA grant scheme is available until 31 March 2023. Companies keen to apply for the Enterprise Development Grant (EDG) must be registered and operating in Singapore, have a minimum of 30% local shareholding, traced to ultimate individual shareholders level, and be in a financially viable position to start and complete the project Support level: SMEs up to 70%; non-SMEs up to 50% of qualified costs. Most projects undertaken by companies should be completed within 12 to 18 months upon successful grant application. 9. Enterprise Development Grant (EDG) - Core Capabilities: Strategic Brand and Marketing Development This is another noteworthy grant from Enterprise Singapore, it co-funds costs of professional marketing and branding consultants to help your company better capture target audiences and markets by differentiating your brand, and your products and services. The grant can cover diagnosis and assessment of company financial value and competition, then research, recommend, and develop strategy plans to optimize marketing resources and improve customer communications. Companies need to be registered and operating in Singapore to apply for this grant. Additionally, the company must have a minimum of 30% local shareholding, and be in a financially viable position to start and complete the project. Support level is similar to automation, SMEs up to 70%; non-SMEs up to 50% of qualified costs. 10. Market Readiness Assistance (MRA) Grant This is a popular grant to help Small and Medium enterprises (SMEs) expand overseas. Support is limited to one activity in a single overseas market with up to 70% of eligible costs, capped at S$100,000 per company per new market:

To be eligible, a business entity must be registered/incorporated in Singapore, and have at least 30% local shareholding. Company's Group Annual Sales Turnover should be not more than S$100 million, OR Company's Group Employment Size should be not more than 200 employees. The last requirement is new market entry criteria, i.e. target overseas country whereby the applicant has not exceeded S$100,000 in overseas sales in each of the last three preceding years. Companies must submit their applications no earlier than six months after the project start date. All claims will be disbursed on a reimbursement basis. The processing time for MRA is about 8 to 12 weeks from the submission of all required information. The Singapore Government offers a great variety of grants to support local farming business. If your business is eligible for any of the grants above, please contact us to get a free consultation to identify suitable grant support and. Thereafter, should you decide to engage us, we can assist you in your end-to-end grant application and claims journey. Images: https://www.freepik.com/free-photo/smart-agriculture-iot-with-hand-planting-tree-background https://www.freepik.com/free-photo/young-plants-growing-very-large-plant-commercial-greenhouse What is Startup SG Tech? Do you have an idea to develop breakthrough technology or thinking of start up a business in technology in Singapore? Then the Startup SG Tech grant is what you need to kick start your business. Founded in 2017, Startup SG Tech supports the local development of proprietary technology solutions with early-stage funding for the successful applicants. Companies may apply for Proof Of Concept (POC) or Proof Of Value (POV) grants depending on the stage of development of the technology/concept. A POC project is a tech solution at the conceptualization stage, you need to clearly explain and prove the concept behind the technology solution. While POV project is a tested concept, which need to carry out development of a prototype, and demonstrate its’ commercial merit. The Startup SG Tech scheme will include share subscription rights of 50% of the awarded grant amount to EnterpriseSG or its selected nominee, up to 49% of the total shareholding of the company. This share subscription rights will take effect when a qualifying equity financing round take place. The grants will be awarded upon the completion of each milestone and cap for POC will remain at $250,000 and POV at $500,000. How to apply for Startup SG Tech? The procedure involves a three-stage application. In the first stage, a summary of the project is submitted to Enterprise Singapore. If after the initial review the project is found to be eligible, a more detailed application has to be submitted in the second stage. Shortlisted applicants from the second stage are invited to present their proposals to a final evaluation panel comprising industry experts. The decision of the evaluation panel is final. There are 3 stages to the application process for Startup SG Tech:

Once again, if you are offered the grant, bear in mind that the grant will carry an equity component where you will be required to increase your paid-up capital by an additional 10% and 20% for the POC and POV grants respectively. For projects that pass all three stages, it takes approximately three months from the date of the second Stage’s submission to receiving Offer letter of the Startup SG Tech grant. After registering the interest, it takes approximately three months, for all three stages of evaluation, before the letter of offer of the grant is received. Who is eligible for this grant?

In order to apply for this grant, companies must meet the following requirements:

The product or solution that your company plans to offer must:

Additionally, your project should fall under one of the following 9 categories:

We can help apply for Startup SG Tech Not sure where to start? Or wonder what is the chance for your company to receive this grant? Real Inbound Consulting (RIC) is here to help you. With over 7 years of continued success in helping companies implement & secure grant funding for grant-supportable projects, you can count on us to be your best partner toward not only Startup SG Tech Grant, but also to achieve ultimate success in your business. Please feel free to Contact Us for free consultation! Launching a new venture whether arising from an already existing business or a completely new concept is not a walk in the park. Hence, the Economic Development Board, actively promotes the Corporate Venture Launchpad 2.0 (“CVL 2.0”), encouraging qualified and Singapore-based companies to consider seeking new ventures opportunities. This program specifically targets established corporates, regional family businesses and high growth companies to build new ventures quickly and effectively, create new growth and revenue streams, and join a growing corporate venturing movement. New venture launching will tap the support and expertise of pre-selected venture studios. The EDB-identified venture studios will showcase its venture-building experience, methodologies and multidisciplinary talent from start to finish, enabling participating companies to thrive and succeed. To qualify for the program, check the following criteria:

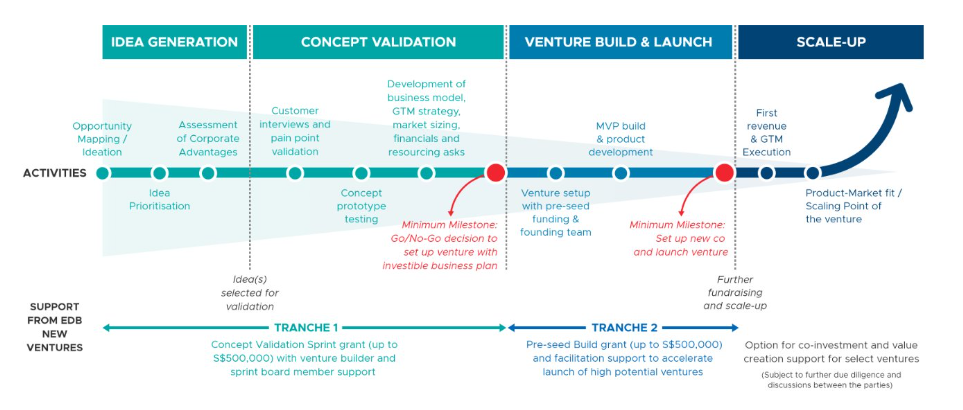

The program also demands the participating companies to hire full-time employees serving as venture leads and the new venture should be headquartered in Singapore. Tranches to succeed The Corporate Venture Launchpad 2.0 (CVL 2.0) program is divided into two tranches. The first tranche is known as Concept Validation Sprints which covers the infancy stage of a venture. It puts emphasis on the corporate venturing goals of the company. In this stage, the new venture undergoes scrutiny by industry experts guided by researched-based validation processes. Coverage:

In the second tranche called Venture Build and Launch, the product or service to be offered to the market is unveiled. New ventures which have successfully completed tranche 1 and considered as high-potential projects advance to the second tranche. Coverage:

The leader of the band As mentioned above, the launching of new ventures will be facilitated and guided by dynamic venture studios. Six venture studios are tasked to assist new ventures from ideation, incubation to building of new ventures. They will provide relevant and industry-based capability building offerings, methodologies, people and resources. These venture studios were selected based on three criteria such as venture-building expertise, track record, and level of commitment. To get more information about the six venture studios, check this. Every year–new companies emerge in the market–offering varying products and services. In Singapore through EDB, new venture launching is wholeheartedly supported by its government through Corporate Venture Launchpad 2.0 (“CVL 2.0”) program. From its infancy stage to the official launching phase, EDB will provide support for participating companies seeking new business ventures in Singapore. Image:https://www.freepik.com/photos/colleagues With the fast-changing economic landscapes, various organizations and institutions including exempt and registered Charities and Institutions of a Public Characters (IPCs) that are non-NCSS (National Council of Social Service) members need to keep up with the technological advancements sweeping across the globe. Various assistance in the form of digital infrastructure grants and a lot more are provided by the government of Singapore. One such grant is exclusive to eligible social services providers. This grant scheme is divided into three categories namely, Charities Capability Fund-Information and Communications Technology (CCF-ICT) Category A, B, and Go Digital Charities. The first two categories focus on infrastructure components and digital solutions upgrades while the third category is specific big and specialized IT solutions needs of the grantees. Let’s take a look at each category: CCF-ICT Category A As mentioned earlier, this category covers the cost of the basic infrastructure components needed in the operation of small and medium-sized charities. The following infrastructure components covered are: 4 computers (desktop or laptop), 2 Printers, 1 broadband account, website development costs to facilitate publishing of charity’s information for transparency, subscription charges of video and audio-conferencing tools, and firewall devices. All of these infrastructure components have respective budget allocations. Successful implementation and completion of the project awards eligible grantees with 100% reimbursement. To know more about this category, visit this website. CCF-ICT Category B Category B funds digital solutions of charities seeking to augment their operations and overall efficiency. Specifically, this category grants financial assistance through pre-scoped and green lane digital solutions. Charities that previously enjoyed VWOs-Charities Capability Fund (VCF) funding may no longer be eligible for this grant unless it falls into the category of enhancement of the granted digital solutions. Detailed information about this category is provided on this website. Go Digital Charities Lastly, this grant provides financial support to charities needing advanced or highly specialized IT solutions. This funding scheme entitles eligible grantees reimbursement into two phases: upon signing of funding agreement and upon project completion. More information is provided on this website. A well-maintained and supported social services are an integral part of every society. Hence, it is imperative that financial support and grants are made available to social services providers in Singapore to help them thrive in the fast technological advancements world. For more information about this grant, kindly visit this website.  The government of Singapore lures local businesses whether SMEs or MNCs to pursue sustainable production and efficient use of energy resources. Programs that promote sustainable ways in energy production are in place allowing eligible businesses to receive financial incentives in return. An example of this is the use of solar panels . The Energy Market Authority (EMA), Building and Construction Authority (BCA) and Economic Development Board (EDB) are the three funding agencies that provide the financial support and assistance to businesses seeking to go green. In a nutshell, the programs are divided into three–financial incentives for solar, followed by schemes for energy efficiency, and lastly for “green” buildings. EMA, BCA, and EDB–the formidable trio schemes Metering credit schemes Solar energy generated by businesses that have adopted solar panels technology allows them to sell the excess electricity generated to the authorized grid authority. To qualify for this, they must first register with SP Services or the Energy Market Company to enjoy this privilege. Three metering credit schemes exist such as Simplified Credit Treatment Scheme (SCT), Enhanced Central Intermediary Scheme (ECIS), and the Market Participant scheme. But only ECIS and the Market Participant scheme are applicable to businesses. Detailed information about these metering credit schemes are available on this website. Let’s talk about energy efficiency The Building and Construction Authority (BCA) and Economic Development Board (EDB) oversee this program by inspiring building owners and investors to adopt energy efficient technologies meaning they switch to green technologies. Since Singapore is aiming to become a Smart Nation, energy consumption in the city-state is expected to spike up, hence, adopting energy efficient technologies is highly encouraged among business entities. To beef up the program, BCA offers two incentives schemes such as–for existing buildings (thru $63 million Green Mark Incentive Scheme) and new buildings (Enhanced $20 million Green Mark Incentive Scheme). To know more, visit their websites GMIS-EB 2.0 and GMIS-NB. Energy Efficient Fund (E2F) by NEA is also available for investors keen to establish new industrial facilities or undertake expansions. This scheme encourages builders to incorporate energy efficient or improving technologies before construction takes place. Detailed information about this scheme is available on this website. Energy Development Board (EDB) The granting agency for the Resource Efficiency Grant for Energy (REG(E)) program promotes energy efficiency especially for manufacturing facilities and data centers. Interested companies are required to submit their project proposal including Pre-Project M&V plan and a post-project M&V report. The grant quantum will be evaluated against the complete carbon abatement upon project completion. To apply to this grant, visit their website. Meanwhile, BCA alongside selected financial institutions collaboratively offer the Building Retrofit Energy Efficiency Financing (BREEF) program which helps qualified businesses shoulder the upfront costs of energy retrofits of existing buildings through an arrangement. To know more about this program, check it out here.

|

Other Recent BlogsTop Government Grants for Cybersecurity Companies in Singapore Top 3 Sustainability Related Grants 2023 Top 3 Grants by the Singapore Tourism Board Top 10 Grants for farming companies in Singapore Fund your startup with The Startup SG Tech CategoriesArchives

July 2024

|